Financial emergencies can pop up at any time in today’s very fast-paced world. From a sudden urgent medical bill, car repair, or a need for cash. Many find themselves in a position when the need for rapid financial aid is necessary. Not always is the classic credit appropriate for these emergency requirements; for this reason, many people resort to payday loans eloanwarehouse. One of the popular payday loan platforms is Eloanwarehouse, a financial professional committed to paying to individuals in need of a sudden cash variant.

However, how reliable are payday loans from e-loan warehouses? There are a few things you would want to understand before you apply for a payday loans eloanwarehouse through their platform. Here in this article, we will give you all the details regarding payday loans Eloanwarehouse, the whole process, the advantages, the downsides, and all the way through the alternatives.

What Are Payday Loans?

Payday loans are small, short-term cash loans designed to offer fast financial assistance to people who require cash before the next payday. The sum of these loans is typically small and ranges from $100 to $1,000. Because payday loans eloanwarehouse are usually unsecured (you don’t need to give any collateral), they can be a simple option for someone in immediate financial distress.

But payday loans come with high interest and fees, they use them beware. If the loan is not paid back as agreed, it can quickly result in a financial crisis because of the snowballing of interest and penalties.

Why choose Eloanwarehouse for payday loans?

Eloanwarehouse is gaining fame as a site looking for companies or individuals in financial need to provide them such thing as daily payday loans eloanwarehouse. What sets this website apart from others? Below are some reasons why individuals check out Eloanwarehouse when evaluating for temporary loans cash.

1. Quick and Convenient Process

One major benefit of payday loans from Eloanwarehouse is the quickness and ease of using the application process. It gives you to have a payday loan applying via the internet without needing to travel. With just a few pounds literally, you submit your application, and once it has been approved the money can be reside into the bank account yours within a few hours, or the next business day. The reason behind is owing to this rapid turnaround, so it is no wonder that Eloanwarehouse is getting requests from individuals who need quick cash.

2. Flexible Loan Amounts and Terms

Another plus of payday loans at Eloanwarehouse is that it offers flexibility in terms of loan amounts and terms. The platform provides payday loans eloanwarehouse with the possibility to borrow from small amounts as $100 to larger sums up to $5,000, depending on what exactly you need. In addition, the payback phrases are distinct and straightforward, on the whole having cautioned with your subsequent pay time; however, this really can be curved in several instances on your financial scenery.

3. Simple Eligibility Requirements

To get a pay-day loan most at Eloanwarehouse, the essential prerequisite is easy. There are a few requirements, and amendments that are to be 18 years old, a U.S. citizen or permanent resident, a valid bank account, and a proof of income in most cases. The simple eligibility requirements of payday loans mean that these types of loans are available to a wide number of people, including those who may have lower than perfect credit.

4. Accessibility and Transparency

Eloanwarehouse is proud to be clear with its customers. The platform guarantees that all loan conditions, fees, and interest rates are perfectly laid out up front to make sure that borrowers know exactly what they are getting into before agreeing to borrow from the platform. These levels of transparency are typical not to be found in the payday loan industry, where unforeseen, costly fees are very complex to understand terms may cause frustration or confusion. Eloanwarehouse performs with trust in customers by being transparent and accessible, doing things openly and straight out, or being sincere.

The Payday Loan Process at Eloanwarehouse

If you wish to use Eloanwarehouse to get a payday loans eloanwarehouse, there are a few things to know in terms to process of the loan. You can find the list of the payday loans eloanwarehouse steps on this platform below:

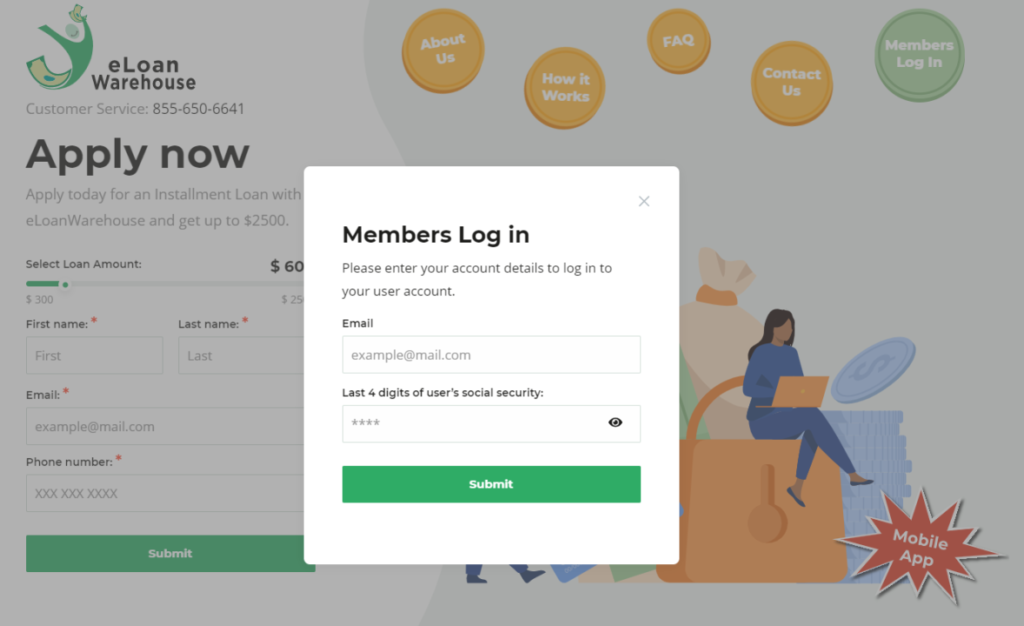

Step 1: Application Submission

The initial step to obtain a payday loans eloanwarehouse would be to fill an online loan request on the Eloanwarehouse website. The application form will require some basic personal and financial information like your name, contact; details, employment status, income details and your bank account details. This info is required to figure out if you qualify and also what your loan will be under in regards to the amount and terms.

Step 2: Approval and Loan Offer

After you apply your application will be evaluated by Eloanwarehouse, it will assess the information and determine if you qualify for payday loan. If you are eligible, you will be presented with a loan offer, which describes the loan amount, interest rate and repayment schedule. Important to read the terms offered carefully and make sure you understand them completely before going ahead.

Step 3: Loan Disbursement

If you agree to the loan terms, the funds will usually more than likely appear in your banking account in hours or next business day, influenced by the platform’s processing procedures. This instant release is amongst the best advantages associated with pay day loans from Eloanwarehouse.

Step 4: Repayment

The final step is repayment. Payday loans are usually due on your next payday, that is when you will owe the loan, including the loan plus charges and fees. Eloanwarehouse provides a variety of repayment options – including automatic bank account deductions or paymanually – depending on what you had agreed upon when you borrowed the cash.

Risks and Downsides of Payday Loans at Eloanwarehouse

While payday advance cash from Eloanwarehouse can deliver rapid financial help, is essential to be aware of the possible risks as well as the shortcomings associated with these kind of short term loans. Some of that risk includes:

1. High-Interest Rates and Fees

One of the biggest negative factors of payday loans is the excessive interest rates and fees. Because of this, these loans are thought of as “high-risk” for lenders, and they come with astronomically high interest rates. Many times, payday loan interest rates go as high as between 300% and 500% APR or more money based on the loan amount and how much you have to return. These costs can quickly pile up, and things become very challenging for the borrowers to repay the loans.

2. Debt Cycle Risk

Many people become trapped in debt cycle, when they borrow payday loans. Given payday loans are limited in length and due around the borrower’s next payday, it may become a challenge for a few men and women to payback the mortgage by the scheduled time. If a loan repayment fails to occur, more penalties as well as interest are added; the total sum that must be repaid becomes even larger. As a consequence, debtors might have to supply another payday loan to repay the original loan, getting into a vicious debt cycle.

3. Impact on Credit Score

While payday loans are generally unsecured and do not involve a credit check, defaulting on repayment of the loan can harm your credit rating. If you happen to miss a payment, Eloanwarehouse or its partner lenders may report post-dated payment of the missed payment to credit bureaus which can lead to damage to credit rating. Remember that this might hinder you from getting a loan later on.

Alternatives to Payday Loans from Eloanwarehouse

Payday loans from Eloanwarehouse may be a fast fix, but they are not always the answer to every person. If you are thinking of finding a payday loan you should also be looking at some other choices before you make a decision. Some potential alternatives include:

- Personal Loans: Personal loans usually have lower rates of interest than payday loan service providers, as well as considerably greater sums. If you have good credit, you may be eligible for a more favorable personal loan.

- Credit Cards: Purchasing an emergency with a credit card may be cheaper, as long as you can pay off the balance in full by the billing cycle to prevent high interest.

- Borrowing from Friends or Family: If you can, take a loan from friends or family members to steer clear of high-interest payday loans.

- Installment Loans: Installment loans provide you with the ability to pay out over a longer duration, which just makes the payment more feasible.

Conclusion

Payday loans Eloanwarehouse can be a viable option for those facing financial emergencies. With quick application processes, flexible loan amounts, and transparent terms, Eloanwarehouse offers a convenient way to access fast cash when needed. However, the high interest rates and fees associated with payday loans eloanwarehouse make them a short-term solution rather than a long-term fix. It is important to weigh the risks carefully and explore alternatives if possible. If you choose to proceed with a payday loans eloanwarehouse, ensure that you understand the repayment terms and are prepared to pay it off on time to avoid falling into a debt cycle.

Read More Blogs 🙂

Gomyfinance.com Credit Score: A Comprehensive Guide to Understanding Your Credit Health